Self-storage operators across the U.S. faced a lackluster leasing season amid a cooling economy. Average rental rates and occupancy levels continued along a downward trend, and most markets failed to make heady gains before heading into the winter months

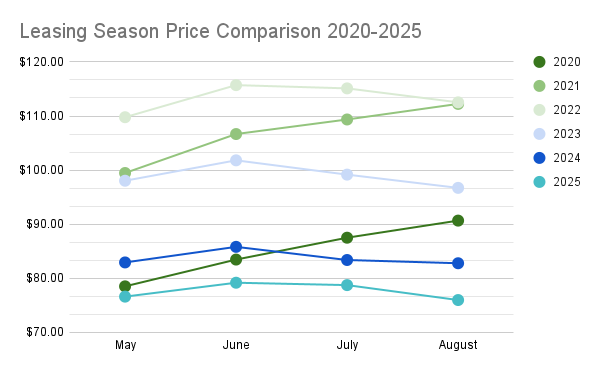

Pricing peaked in June at $79.19 a month and declined heading into the rest of the summer. That means average prices in August ended up being less than they were in May, a net drop of 63 cents over the course of the rental season. The average self-storage rental rate in August was $75.99 a month, an 8.2% drop from the same month a year ago and a more than 32% decline from the August 2022 peak of $112.53.

The economy cast a cloud on the summer surge

The bulk of the self-storage industry has faced a difficult operating environment over the last few months as the larger economic picture beared down on demand. Revised data over the summer showed the U.S. economy shrank more than originally reported during the first quarter and consumer spending fell sharply to its lowest level since the pandemic ended. A new UBS report pegged the likelihood of the US entering a recession in the coming months to 93%.

Home sales fell to a 30-year low and sellers currently outnumber buyers by a wide margin. According to a report from DXD Capital, “the U.S. housing market currently shows an estimated 1.9 million active sellers versus 1.5 million buyers which should equate to pent up self storage demand and a tailwind for the sector once capitulation in the housing market occurs.”

For now the gap between buyers and sellers isn’t budging yet, as pricing remains at record levels and many sellers are pulling listings rather than cutting pricing. U.S. Treasury Secretary Scott Bessent recently signaled that the government could declare a housing emergency in the fall, highlighting the emerging affordability crisis that is having a dampening effect on growth in the self-storage industry.

As a result of the sapped demand, operators did not fare much better on the occupancy front either, despite heavily discounted prices. Occupancy for stabilized facilities stood at 84.69% in August 2025, up just over 1% from the start of the busy season in May. Since August 2024, operators have shed 71 basis points of occupancy.

It was the best of times, it was the worst of times.

While overall demand and occupancy is down, the current picture is more akin to the novel War and Peace. For some operators it is the worst of times, for a few others it is the best of times. About 37% of the top 300 markets by reservations grew rental rates year over year, while the rest lost pricing power over the last 12 months.

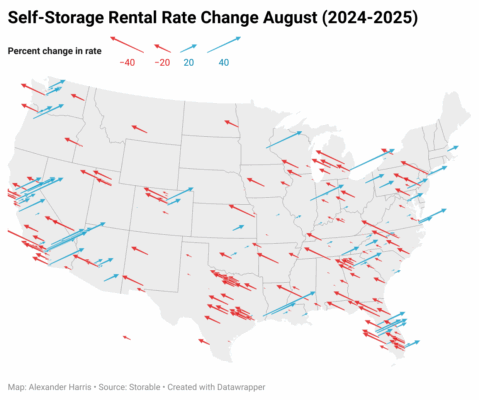

Below is a map showing the geographic distribution of the changing velocity in storage rates from August 2025 and the previous year.

Looking at the markets where operators grew rates and the markets where rates fell, a few notable patterns emerge. Storage rates rose mostly in supply-constrained coastal markets, with the highest concentration of growth markets in California, along with pockets of strength in Colorado, Florida, Texas, and knowledge-driven Southern metros like Nashville, Raleigh and Richmond. Other key areas seeing rate growth include Manhattan, Oklahoma City, Akron, and Tucson.

Declining rate markets were mostly distributed throughout secondary and tertiary markets in the Sunbelt and Rustbelt. The five major markets of Texas (Austin, San Antonio, Dallas, Houston and El Paso) saw rate declines. Las Vegas saw rates fall by 26 percent year-over-year in August.

Below are the top and bottom markets by rental rate growth from August 2024 to August 2025.

There appeared to be little correlation between population growth and rental rate growth. What seems to be a more important factor in determining rate growth are incomes. Growing markets tend to also have higher median incomes, while declining markets appear to tend towards lower incomes in comparison.

What this shows is that the economic contraction is hitting lower income storage renters first. They aren’t moving as much and they aren’t changing jobs, so storage is becoming much more of a discretionary expense. Higher income buyers on the other hand have been more active in the housing market, according to Realtor.com the $1-million-plus category of homes has been the fastest growing segment over the last 21 months. The customer base in high income areas are less price sensitive, and tends to absorb more aggressive increases on in-place rents for storage. Operators in such markets are well-situated to weather the current economic environment.

Leasing Season in Review

After a period of explosive growth during the pandemic period, the current softness in the storage industry feels like a bit of a shock. The current economic outlook is uncertain, but several indicators point to worsening conditions when it comes to growth, jobs and housing—all of which are key drivers of storage demand.

However storage remains a reliable, high-margin and resilient business overall, that is ultimately more impacted by economic conditions on the local and micro level. In the current state of things, high-income markets with high-barriers to entry are poised for growth, while lower income markets, and those reliant on tourism and industry, appear most likely to contract in the short term.