Storage Monitor: Average Storage Rates Reach 3-Year Low

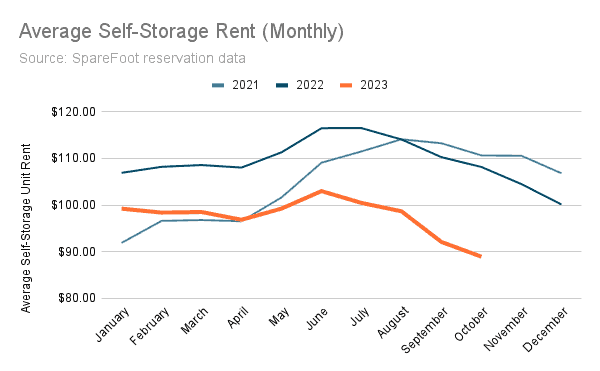

The average price of a self-storage unit was $88.93 in October, according to SpareFoot reservation data. That’s the lowest monthly storage price since June of 2020.

Since last year, the average street rate for a self-storage unit has fallen more than 17.7%, putting the squeeze on self-storage operators across the country. Demand for units has fallen as U.S home sales have dropped by 15.4% in September, according to the National Association of Realtors.

Contributing to the freeze in the housing market are record high mortgage rates, which reached 8% recently—the highest rates since the turn of the millennium. Combine that with falling inventory levels and rising prices, and it isn’t hard to see why both buyers and sellers are sitting on the sidelines. Buyers are priced out, and would-be sellers have more incentives to stay put than to change homes.

That lack of activity is clearly having a corresponding impact on the self-storage industry as storage operators lower prices to combat falling occupancy.

Occupancy

Based on Storable data, average self-storage occupancy reached record highs of around 92% during 2021 and 2022. Over the last six months, occupancy rates have fallen towards pre-pandemic levels of around 87% as of September 2023.

The shift in occupancy reflects changes in tenant behavior away from more discretionary use cases for storage such as making room for a home office or completing a home remodel. Instead, more people moving into storage today have a need-based reason for renting such as downsizing or moving in with family members. These new renters are more price-sensitive, putting further pressure on operators to lower rates in order to draw in tenants.

The change in demand is further reflected in Google Search demand for industry-related keywords, which have fallen year over year, without the usual expected increase in search volume during the spring and summer months.

What’s next?

Unfortunately for the nation’s self-storage operators, a thaw in the U.S. housing market doesn’t appear to be coming anytime soon. Interest rates are expected to remain elevated for the time being, and economists anticipate home prices to rise slowly in the coming months due to dwindling supply. According to Fortune, more than 90% of current homeowners have a sub-6% interest rate, which means most are reluctant to sell their home and enter into a new mortgage at today’s rates.

With this key driver of demand on ice, storage operators may be facing a lean winter. To bolster revenue, operators may employ several strategies including cutting costs, increasing efficiency through technology and automation, exploring additional incremental revenue streams, and tightening cyberdefenses to reduce vulnerability to unexpected losses. Storable can help you accomplish these goals and more, contact us to learn how./p>

Storage Monitor: Rates Drop Again, Occupancy Turns a Corner

Steep discounting in the self-storage industry continued in April, as many operators contended with weakened demand and excess capacity. But the race to the bottom for pricing might be over, as occupancy ticks up slightly and the moving season begins. Keep Reading

Connecting and Innovating at the Inside Self Storage World Expo – A Storable Recap

This year's Inside Self Storage World Expo at Caesar's Forum in Las Vegas was not just another event for us at Storable; it was a showcase of passion, innovation, and community. Our dedicated Storable team came excited and left inspired. Our commitment is always to you—our valued customers—and understanding your unique challenges and experiences firsthand. Keep Reading

Storage Monitor: Rates and Occupancy Continue Pullback

The self-storage industry is known for thriving in good times and bad times, but what about the in-between times? Keep Reading