Storage Monitor: How much did storage rates fall in 2023?

Storage Monitor: How much did storage rates fall in 2023?

Self-storage rates tumbled in 2023, experiencing their biggest year-to-year decline in over a decade.

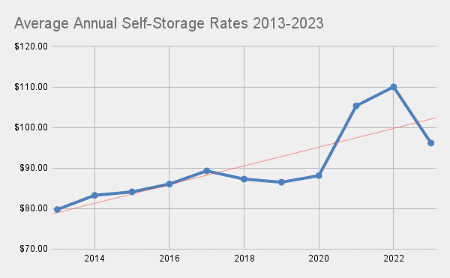

The average price to rent a self-storage unit was $96.16 per month in 2023. That marks a 12.59% decrease from the $110.01 per month average recorded in 2022, a year in which post-pandemic prices surged amid climbing occupancy rates and overall inflation.

Storage rates declined in 2023

In 2023, storage demand suffered from a freeze in the U.S. housing market as the Federal Reserve increased interest rates, increasing the cost of home ownership and disincentivizing current homeowners from selling. This trend has contributed to making 2023 the slowest year on record for relocations, with just 7.8% of the U.S. population making a move last year.

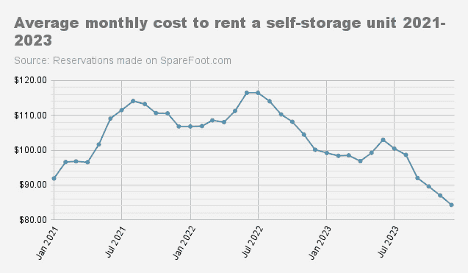

Another factor affecting rates was the rise in move outs as the remaining disruption from the COVID crisis came to a close, contributing to a 4.5% slide in average annual occupancy from 2022 to 2023. While last year saw the return of seasonality, the lift in prices during the busy moving season was slight compared to historical trends.

During the second half of 2023 rates declined back towards lockdown-era pricing levels. The average rate in December 2023 was $84.30 a month—marking the lowest monthly average price since May of 2020. While receding from the highwater mark of 2022, average rental rates last year are still 9.13% higher than in 2020 when the pandemic began.

A 10-year trend of storage rate growth

Taking a more long-term view, self-storage rates have risen 20.55% since 2013, an average annual rate of 1.89%. As you can see in the chart below, the pandemic surge in pricing lifted the storage industry out of a declining rate environment that took hold starting in 2017. In 2023, prices reverted back below the 10-year trend line.

Going forward, economic conditions in 2024 could support a reversion closer to the historical mean as the housing market slowly warms up and more demand for storage is stimulated. Hopefully, demand will increase as the Federal Reserve lowers interest rates and mortgage premiums continue to moderate. At some point, the demand being pent up in the housing market will be released, giving the storage industry a shot in the arm.

The other scenario operators are hoping to avoid is a return of the downward trajectory that prices were on prior to the pandemic. However, this scenario seems less likely given the industry’s increased sophistication when it comes to dynamic pricing and digital engagement, as well as the degree of consolidation and institutionalization that has taken place over the last few years.

2023 in review

The self-storage industry witnessed a significant decline in rental rates in 2023, influenced by factors like the icy U.S. housing market and the end of pandemic-related disruptions. Although rates dipped below the 10-year trend line, the industry’s long-term growth remains evident, with rates still higher than pre-pandemic levels. Looking ahead, the industry faces uncertainties but remains hopeful. Empowered by advanced pricing strategies and digital marketing tools, storage operators are more prepared than ever to navigate potential challenges and capitalize on the next upswing in demand.

Storage Monitor: Rates Drop Again, Occupancy Turns a Corner

Steep discounting in the self-storage industry continued in April, as many operators contended with weakened demand and excess capacity. But the race to the bottom for pricing might be over, as occupancy ticks up slightly and the moving season begins. Keep Reading

Connecting and Innovating at the Inside Self Storage World Expo – A Storable Recap

This year's Inside Self Storage World Expo at Caesar's Forum in Las Vegas was not just another event for us at Storable; it was a showcase of passion, innovation, and community. Our dedicated Storable team came excited and left inspired. Our commitment is always to you—our valued customers—and understanding your unique challenges and experiences firsthand. Keep Reading

Storage Monitor: Rates and Occupancy Continue Pullback

The self-storage industry is known for thriving in good times and bad times, but what about the in-between times? Keep Reading