State of the Industry: Pricing and Occupancy Fall After Record Setting Year

The post-pandemic period brought unprecedented levels of growth to the self-storage industry, but a return to normal is on deck for operators in 2023.

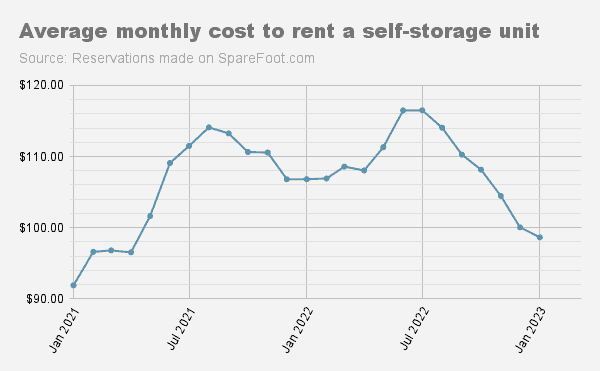

Self-storage pricing fell rapidly during the second half of 2022 as operators sought to offset rising move out activity and falling occupancy. A review of Storable data from 2022 shows that average per unit pricing peaked in July at $116.50. Prices have declined more than 15% since then as operators lowered prices earlier than normal.

Pricing power slips

This phenomenon – combined with the growing pace of move-outs – means that many outgoing renters will be replaced by more price-sensitive tenants. This will put a significant drag on operator revenue in the months to come.

In January 2023, the average price per storage unit stood at $98.64, down more than 7.6% compared to the same month a year ago. On a positive note, operators are still holding on to some of their pandemic pricing gains, with current prices up more than 14% compared to January 2019. How much pricing power the industry holds onto until the spring leasing season kicks off remains to be seen.

Move-outs accelerate

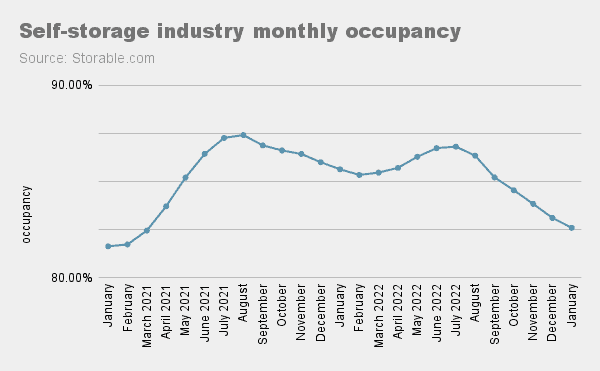

Declining storage prices are in large part a response to operators looking to address falling occupancy rates. As of December 2022, operators had lost 3.6% occupancy compared to the same month a year ago.

As the demand drivers created by the pandemic have dissipated, many tenants who rented during that time have left their units. Meanwhile inflation made consumers more price sensitive, pushing some tenants out of storage and keeping new ones from coming in as rates reached record highs over the summer. Home sales have stagnated and high apartment rates are keeping renters in place. These conditions contribute to the current industry doldrums.

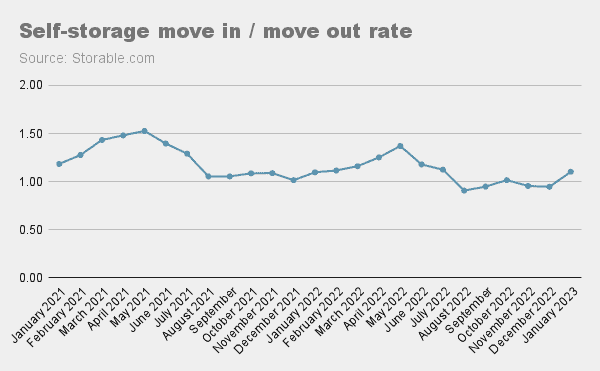

In August 2022, move-outs outpaced move-ins for the first time since the start of the pandemic. The chart below shows the monthly move-in and move-out ratio. A ratio below 1.0 means that there are more move-outs than move-ins. The MIMO ratio for August was .95, meaning for every 95 move-ins, there were 100 move-outs.

As you can see, move-outs exceed move-ins for most of the second half of 2022. This trend is a reversal from the previous two years, however it marks a return to normal seasonality patterns.

One major issue operators will contend with in the months to come is the changing tenant mix. As tenants that rented at the height of the market move out, they are being replaced by more price sensitive tenants that are downsizing homes or experiencing some form of economic dislocation. As more tenants come in at the lower pricing, operators will start to see softening of their overall revenue and NOI growth.

The challenge ahead

The good news is that the outsized growth of the industry during the pandemic has allowed the industry as a whole to find a soft landing amid the current moment of economic uncertainty.

However, some major headwinds remain as operators look ahead to 2023:

- Revenue pressure. Declines in occupancy and rental rates will soften operator revenue in the short and medium turn.

- Cost pressure. Labor costs remain high and marketing costs are growing. Changes that Google made to its search algorithm combined with rising CPC costs have put upward pressure on marketing acquisition costs. (In fact, the cost-per-click for our top storage-related search terms increased by 22% YoY for the month of August.)

- Limited access to capital. Operators looking to grow through acquisitions may have limited options as interest rates climb.

These factors all add up to NOI pressure that operators will be under for the foreseeable future.

In 2022, operators pushed pricing to its ceiling. Now that demand has slacked, operators will need to take the following steps to grow in 2023: strike the right balance between occupancy and rate, invest in marketing that captures local demand and reduce operating expenses with different levels of automation and remote management.

What does California’s New Honest Pricing Law Mean for Self-Storage Operators?

The Honest Pricing Law represents a significant shift towards greater transparency in pricing for businesses operating in California. The law eliminates hidden fees and ensures that customers are fully informed about the total cost of a service or product before making a purchase. Keep Reading

Doing More: Storable Releases Annual Corporate Responsibility Report

Sustainable and socially responsible business practices improve operational efficiency, drive innovation, and contribute to strong financial performance over the long-term. They are also becoming critical factors when it comes to accessing capital and attracting top talent. Keep Reading

Storage Monitor: Top Performing Markets for Rental Rate Growth

Storable looked at the top 200 most popular markets for self-storage rentals and calculated the average rental rate year to date through June for each, and compared to the same period in 2023. In our analysis, only 18 markets show positive average rental rate growth compared to last year. Keep Reading